Asset Utilization Ratio Formula

The rate of return is calculated based on net asset value at the beginning of the period and at the end of the period. Firstly the daily rate of return of the concerned portfolio is collected over a substantial period of time ie.

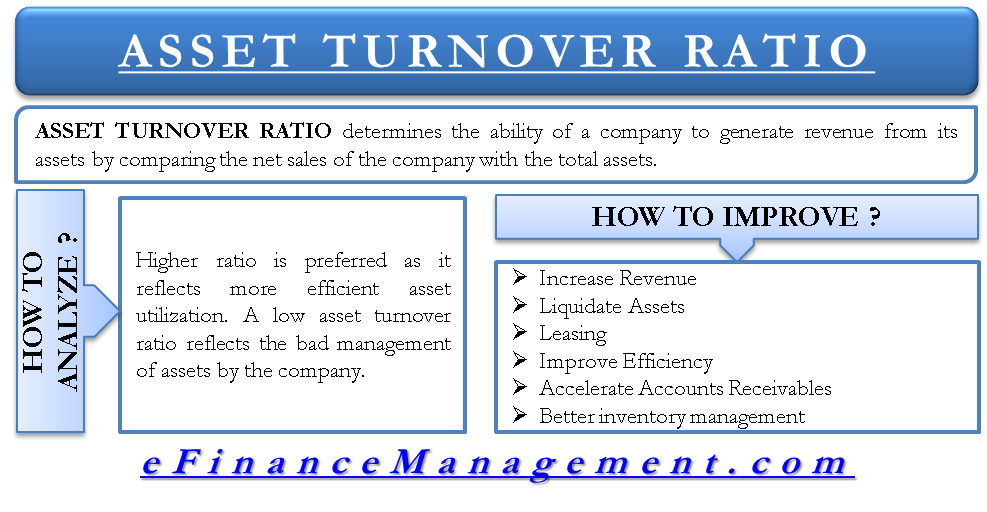

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

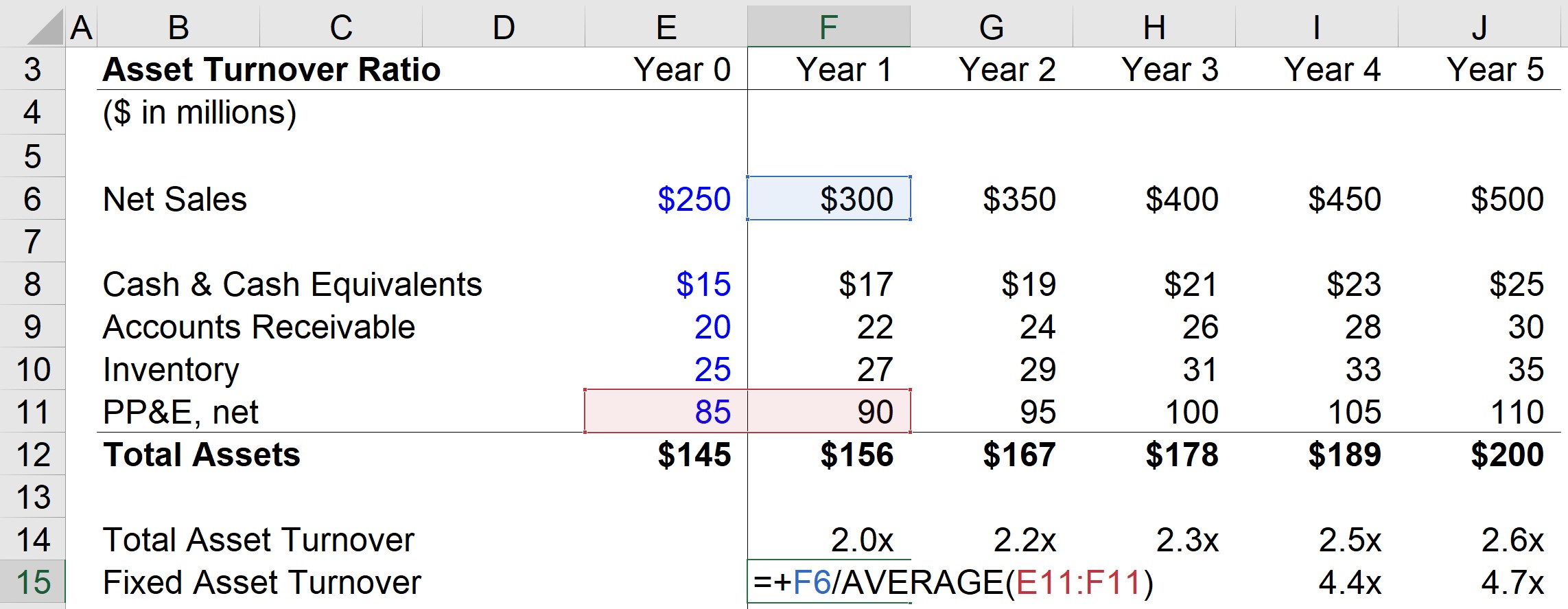

The fixed assets turnover ratio measures the efficiency of a business in utilizing its fixed assets.

. The formula for the Sharpe ratio can be computed by using the following steps. 3 Fixed Assets Turnover Ratio. Which may be due to poor utilization of fixed assets poor collection methods or poor inventory management.

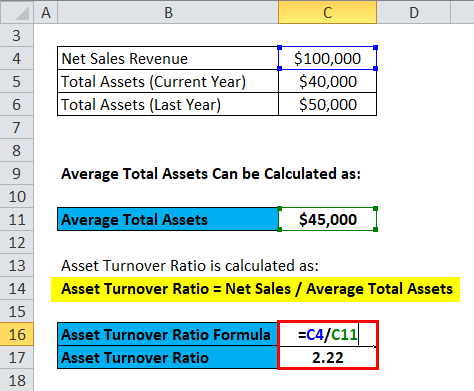

The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company. Explanation of the Sharpe Ratio Formula. The net fixed assets include the amount of property plant and equipment less the accumulated depreciation.

Asset Turnover Ratio is used in multiple ways one of which is its usage is DuPont Analysis. The DuPont Analysis calculates the Return on Equity of a firm and uses profit margin asset turnover ratio and financial leverage to calculate RoE. Generally a higher fixed asset ratio implies more effective utilization of investments in fixed assets to generate revenue.

Asset Turnover Ratio Formula Example 3. This ratio divides net sales by net fixed assets calculated over an annual period. RoE Profit Margin x Asset Turnover x Financial Leverage.

A higher total asset turnover ratio depicts the efficient performance of the business. Total Assets Turnover Ratio 533. A company with a high asset turnover ratio operates more efficiently as compared to competitors with a lower ratio.

It shows how the company uses fixed assets to generate revenue.

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Activity Ratio Formula And Turnover Efficiency Metrics Excel Template

No comments for "Asset Utilization Ratio Formula"

Post a Comment